Do you scour the internet for 'knock inknock out kiko options essay'? Here you can find the questions and answers on the subject.

Table of contents

- Knock inknock out kiko options essay in 2021

- Knock inknock out kiko options essay 02

- Knock inknock out kiko options essay 03

- Knock inknock out kiko options essay 04

- Knock inknock out kiko options essay 05

- Knock inknock out kiko options essay 06

- Knock inknock out kiko options essay 07

- Knock inknock out kiko options essay 08

Knock inknock out kiko options essay in 2021

This image illustrates knock inknock out kiko options essay.

This image illustrates knock inknock out kiko options essay.

Knock inknock out kiko options essay 02

This image representes Knock inknock out kiko options essay 02.

This image representes Knock inknock out kiko options essay 02.

Knock inknock out kiko options essay 03

This image representes Knock inknock out kiko options essay 03.

This image representes Knock inknock out kiko options essay 03.

Knock inknock out kiko options essay 04

This image demonstrates Knock inknock out kiko options essay 04.

This image demonstrates Knock inknock out kiko options essay 04.

Knock inknock out kiko options essay 05

This image demonstrates Knock inknock out kiko options essay 05.

This image demonstrates Knock inknock out kiko options essay 05.

Knock inknock out kiko options essay 06

This picture shows Knock inknock out kiko options essay 06.

This picture shows Knock inknock out kiko options essay 06.

Knock inknock out kiko options essay 07

This picture illustrates Knock inknock out kiko options essay 07.

This picture illustrates Knock inknock out kiko options essay 07.

Knock inknock out kiko options essay 08

This picture representes Knock inknock out kiko options essay 08.

This picture representes Knock inknock out kiko options essay 08.

When does a knock out event occur on a Kiko?

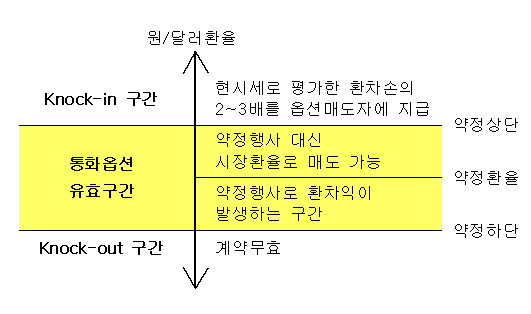

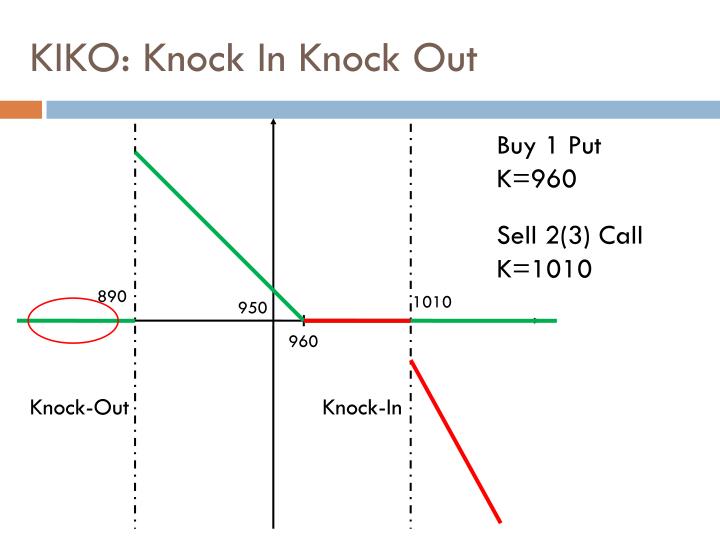

These specific spot rates are known as the barrier levels and a crossing of this barrier is known as a barrier or trigger event (New York Fed. 2000 and Cheng 2003). For a KIKO to become active it must first be knocked in; however, a knock-out event can occur at any time before the options maturity.

What are the knock in and knock out options?

Knock-in/Knock-out (KIKO) options are a type of exotic derivative – or more specifically barrier options – which as the name suggests are an option consisting of a knock-in and a knock-out component.

Is there one knock in and one knock out barrier?

In this Barrier options type there is one knock in and one knock out barrier. In the market KIKO is applied in two ways according to the validity period of the Knock Out; Option is opened invalid at the trade date.

How are Kiko options priced in the market?

In the market KIKO is applied in two ways according to the validity period of the Knock Out; Option is opened invalid at the trade date. If until expiration Knock In barrier is hit and Knock Out barrier is not hit option will be priced like a Vanilla option at the expiry date.

Last Update: Oct 2021